Business opportunities in the financial market are risky, and some are better than others. Forex represents the largest currency trading marketplace in the world. If you’d like to make the most of Forex opportunities, study these tips.

The forex markets are especially sensitive to the state of the world economy. Before starting forex trading, there are some basic terms like account deficits, trade imbalances, and fiscal policy, that you must understand. Without a firm grasp of these economic factors, your trades can turn disastrous.

To succeed in Foreign exchange trading, you should try and eliminate emotional criteria from your trading strategies. This keeps you from making impulsive, illogical decisions off the top of your head and reduces your risk levels. While your emotions always impact the way you conduct business, it is best to approach trading decisions as rationally as possible.

Note that there are always up and down markets, but one will always be dominant. It is generally pretty easy to sell signals in a growing market. When deciding on which trades to be involved in, you should base your decision on current trends.

Early successes at online trading can cause some people to become avaricious and trade in a careless fashion that can be detrimental to their earnings. You can lose money if you are full of fear and afraid to take chances. It is important to keep your emotions under control and act based on knowledge, not a feeling that you are experiencing.

Forex is not a game and should be done with an understanding that it is a serious thing to participate in. Some people can get caught up in the moment, and lose site of the fact that it is their own real money they are investing and trading, and end up taking a huge loss. Going to a casino, and gambling their savings would probably be less risky.

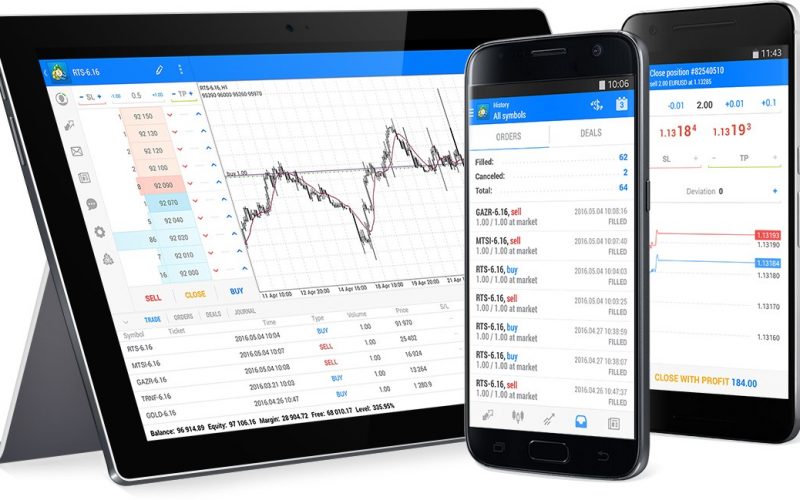

You do not have to purchase an automated software system to practice Forex with a demo account. Just access the primary forex site, and use these accounts.

Learning to properly place a stop loss on your foreign exchange trades is more art than science. You need to take note of what the analytics tell you, and combine them with your trader’s instinct to beat the market. Developing your trading instinct will take time and practice.

Using a mini-account and starting out with small trades may be a wise strategy for investors new to Forex. It is important to learn the ins and outs of trading and this is a good way to do that.

You shouldn’t follow blindly any advice you read about forex trading. Some information will work better for some traders than others; if you use the wrong methods, you could end up losing money. Learn about the various changes in the market’s technical signals and plan your strategy accordingly.

A relative strength index can help you gauge the health of different markets. This will give you a basic idea of the trends and potentials that a market holds. You will want to reconsider getting into a market if you find out that most traders find it unprofitable.

There is no “trading central” in forex. This means that there is no one event that can send the entire market into a tizzy. In the event of a disaster, do not panic and practice flighty selling. As with any market, major events will have an influence on the forex market, but not always on the currency pair you’re currently trading in.

Never move your stop point in mid-session. You should define a stop point before opening your position, and its success or failure must not tempt you to change your point. Moving a stop point may be a greedy and irrational choice. This is usually leads to losing money.

Analysis is a large part of Forex trading, but you also need to have a good attitude and be willing to take some risks. In this way, you will find success. If you take the time to know the basic techniques on how the market works, you will be able to devise a plan that will help you succeed.

You need to understand the underlying danger of a decision before it is safe enough to make it. Get help from your broker, as they can help you with financial issues.

Unfortunately, there is no guaranteed way to make money on the forex market. There are a lot of things on the market that claim to guarantee success in Forex trading including books, videos and robots. Practice makes perfect as you learn from the mistakes you’ve made and give it your best shot.

Make sure your trading style fits how much time you can dedicate to trading. If you have trouble looking for hours to trade during the day, try making your strategy based on delayed orders by picking a bigger time frame, such as a monthly one.

Use a mini account when you begin. This is similar to a practice account; however, it allows you to participate in real trades, and requires you to spend real money. It is an easy way to test the waters, so you can determine which trading forms you prefer and which ones work best with your personal trading style.

The tips you’ve read are all used by real forex experts who have real success. While there is no promise of success, implementing some of the Forex ideas, tactics, and tricks presented here will go a long way to improving your chances of becoming a profitable Forex trader. If you take your trading efforts seriously, there is unlimited earning potential.