“Forex” is the informal term for the foreign currency markets, which are extremely accessible to anyone with a computer. This article can help you learn about forex trading and, it can help you start earning money in your trades.

Forex is directly tied to economic conditions, therefore you’ll need to take current events into consideration more heavily than you would with the stock market. Before starting to trade forex, it is important that you have a thorough understanding of trade imbalances, interest rates, current account deficits, and fiscal policy. If you don’t understand these basic concepts, you will have big problems.

Do not use any emotion when you are trading in Forex. Your risk level goes down and you won’t be making any utterly detrimental decisions. There’s no way to entirely turn off your emotions, but you should make your best effort to keep them out of your decision making if at all possible.

Keep a couple of accounts when you are starting out in investing. One account is your live trading account using real money, and the other is your demo account to be used as a testing ground for new strategies, indicators and techniques.

It is best to stay away from Forex robots, and think for yourself. Though those on the selling end may make lots of money, those on the buying end stand to make almost nothing. It is up to you to decide what you will trade in based on your own thoughts and research.

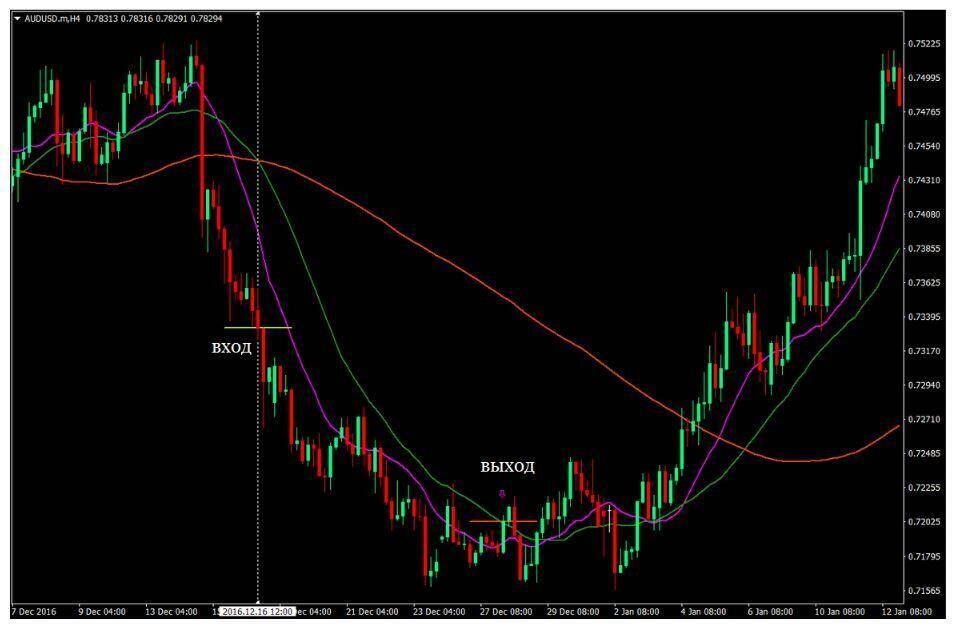

Four hour as well as daily market charts are meant to be taken advantage of in forex. As a result of advances in technology and communication, charts exist which can track Forex trading activity in quarter-hour periods, as well. The downside of these rapid cycles is how much they fluctuate and reveal the influence of pure chance. Stick with longer cycles to avoid needless stress and false excitement.

Research your broker when hiring them to manage your Forex account. You want a broker that has been performing at least on par with the market. You also want to choose a firm that has been open for more than five years.

Vary the positions that you use. Many traders fall into the trap of opening with the same position. This can cause you to make money mistakes. If you want to have success at Forex, you must alter your position based upon the current trades.

It’s advisable to begin foreign exchange trading efforts by maintaining a mini account and try it out, at least for a year. This will help as preparation for success over the long term. Only investing a small amount when you are first starting out is a good idea, until you learn more about trading.

In reality, a winning plan of action is the exact opposite. Come up with a plan for your trading ventures to help you avoid acting upon your impulses.

Stop Loss

Set up a stop loss marker for your account to help avoid any major loss issues. Stop losses are like an insurance for your forex trading account. If you don’t set a stop loss point, major fluctuations can happen without you being able to act on them and the result is a significant loss. A placement of a stop loss demand will safeguard your capital.

When evaluating trading platforms, look for ones that allow you a variety of methods to access market information. Some platforms can send alerts to your mobile phone, but they also allow your trade and data on your phone. This means you can react quickly, even when you are away from the computer. You should always have internet access so you don’t miss any chances.

One of the perks of Forex is that you have the ability to make trades on a global level. With a measure of discipline and planning, Forex trading can be a lucrative venture that is managed on your own time frame, from anywhere in the world.